As the April 30th annual tax filing deadline fast approaches, many Canadian investors find themselves scrambling to find last-minute strategies to lower their tax burden. However, the truth is that the most effective tax-saving strategies are not concocted in the eleventh hour but rather are prudently implemented throughout the year. Tax efficiency in investment portfolios is not a seasonal endeavor but a year-round commitment that requires strategic planning and consistent execution. By understanding this fundamental principle, investors can take proactive steps to optimize their investment strategies and maximize their after-tax returns.

In this blog post, we’ll delve into the importance of tax efficiency in investment portfolios and provide helpful tips for investors to lower their tax burden.

The Importance of Tax Efficiency in Your Portfolios

Many Canadians have used their tax-advantaged accounts to great effect, whether it is saving for retirement through RRSPs & LIRAs for tax deferred growth, saving for their children’s education through a tax-deferred RESP, or contributing to TFSAs for tax-free growth. However, when it comes to investments outside these tax-advantaged accounts, investors need to be particularly astute. There are many factors in your investment portfolios that can contribute to your higher tax bill that you need to consider when your assets are outside of a tax-advantaged account. For example, a primary consideration for investors are the capital gain distributions that are paid annually from your investments, as well as your investment income & taxable dividends you receive throughout the year. All of which are reported on your T3 & T5 slips.

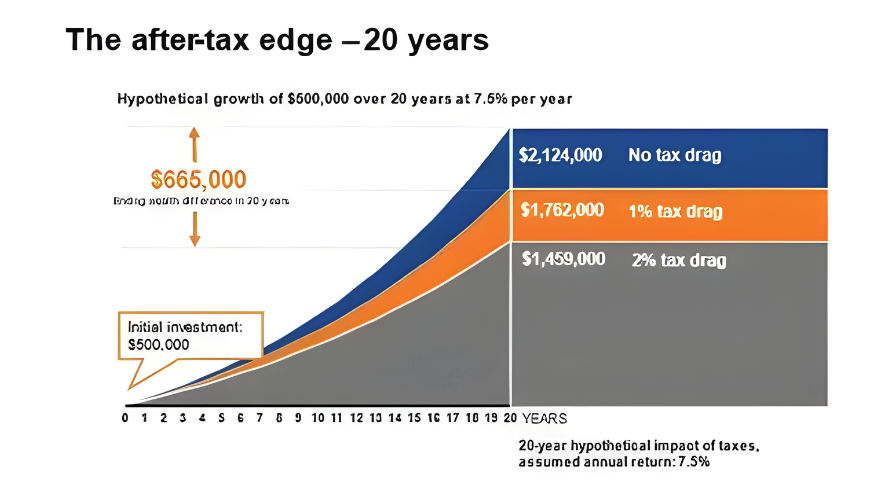

According to a Morningstar study titled “When Bad Taxes Happen to Good Funds,” the average equity mutual fund lost 1.48% of their overall returns to taxes from 2010-2020. To illustrate the impact of this concept commonly referred to as “Tax Drag,” consider the impact on a $500k portfolio below.

Get more strategic with your investments

Join our community of high net-worth investors by subscribing to our monthly newsletter. You’ll receive tips on tax planning, investment trends and more.

Three tips for a Tax-Efficient Investment Strategy

Now that we understand why it’s important to minimize your annual tax owings and reduce your portfolio’s “tax drag,” here are three simple ways you can optimize your investment portfolios for tax efficiency:

- Maximize Your Contributions to Tax-Advantaged Accounts

Maximizing your annual contributions to your RRSPs, RESPs and TFSAs offers an effective means to defer or reduce your tax obligations while garnering deductions on your taxable income. Building significant savings in your registered accounts provides the flexibility to devise a tax-efficient withdrawal plan. For instance, supplementing RRIF withdrawals with a well-funded TFSA for retirement income, rather than solely relying on RRIF funds, enables you to remain in a lower marginal tax bracket to mitigate potential OAS clawback. This strategy is advantageous since each dollar withdrawn from a RRIF is taxed at your marginal tax rate.

- Consider splitting your income or pension with your spouse

This leads to the second tip, which is to consider splitting your pension income with your spouse. This strategy allows the higher earning spouse to transfer taxable income attribution from them to their lower income spouse, resulting in a net tax savings. Many might think this refers to your traditional defined benefit pension income, however it is far more applicable. “Pension income” can also include RRIF & LIF withdrawals, and annuity income. Pension income can be split up to 50% amongst spouses.

- Consider Where You Hold Your Investments

As you may have heard before, “Asset Allocation” refers to building a proper well diversified investment portfolio that suits your investment risk profile and overall situation. For example, a retiree is more likely to have an asset allocation around 60% equity and 40% fixed income whereas a young accumulator with 20 years to retirement is more likely to focus on growth and have an 80% equity 20% fixed income portfolio. However, there is another important term coined in our industry called “Asset Location”. That is, the practice of mindfully placing investments in your accounts with the goal of maximizing tax efficiency. For example, holding Canadian dividend-paying equities in non-registered accounts can benefit from favourable tax treatment and tax credits. On the other hand, foreign dividends may be better suited for tax-sheltered accounts like TFSAs and RRSPs, where dividends are not taxed.

In conclusion, as the tax filing deadline looms, it is helpful for Canadian investors to understand that effective tax-saving strategies extend far beyond last minute efforts. Tax efficiency in investment portfolios requires year-round commitment and strategic planning. By proactively optimizing your investment strategies, investors can enter the tax filing annual deadlines with more confidence and peace of mind.

We Can Help

Through our tried and true process, we’ve helped hundreds of investors develop strategies that empower them to live life on their terms. Take action today for a better tomorrow.