The phrase “Time in the markets beats timing the markets” is a revered mantra among investors, coined by the legendary investment analyst Ken Fisher. This wisdom serves as a timely reminder for investors to remain patient, especially during periods of market uncertainty.

July continued a stellar year for stocks, with the S&P 500 gaining 1.2%, bringing its year-to-date increase to an impressive 16.7%. However, the market quickly reversed course in early August, with the S&P 500 shedding 7% in just five days, erasing months of gains. This sudden downturn officially signals a market correction.

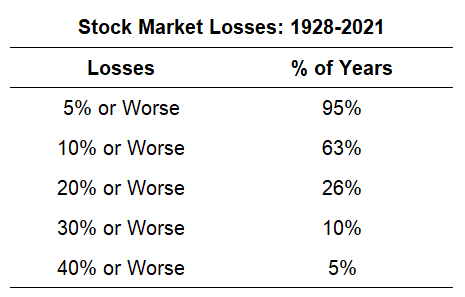

Such sharp movements, though unsettling, are a normal part of market dynamics, especially during periods of growth. Historical data, dating back to 1928, shows that in 95% of calendar years, major indexes experience a drop of 5% or more at some point.

Despite these movements happening fairly frequently, it does not make the downturns any less painful for investors. However, this month’s blog post will focus on what we have learned from previous corrections, and how we can apply these learnings today.

Invest for the Long Term

Join our community of high net-worth investors by subscribing to our monthly newsletter. You’ll receive tips on tax planning, investment trends and more.

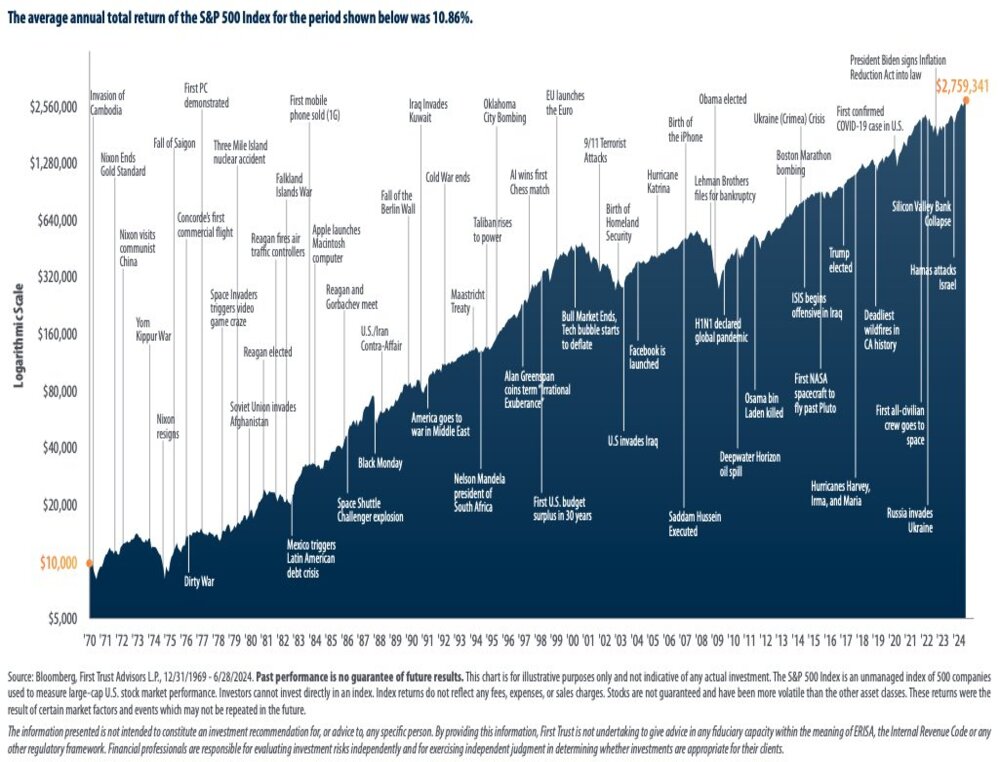

The legendary investor Sir John Templeton once famously warned, “The most dangerous four words in investing are: this time it’s different.” Market volatility is not a new concept, with the most recent significant event being the Coronavirus pandemic. Such events, often referred to as “Black Swan Events,” are high-impact, difficult-to-predict occurrences that, in hindsight, seem inevitable. Despite these influential events, the U.S. stock market has averaged a remarkable 10.83% annual return since 1970, even after weathering numerous Black Swan events.

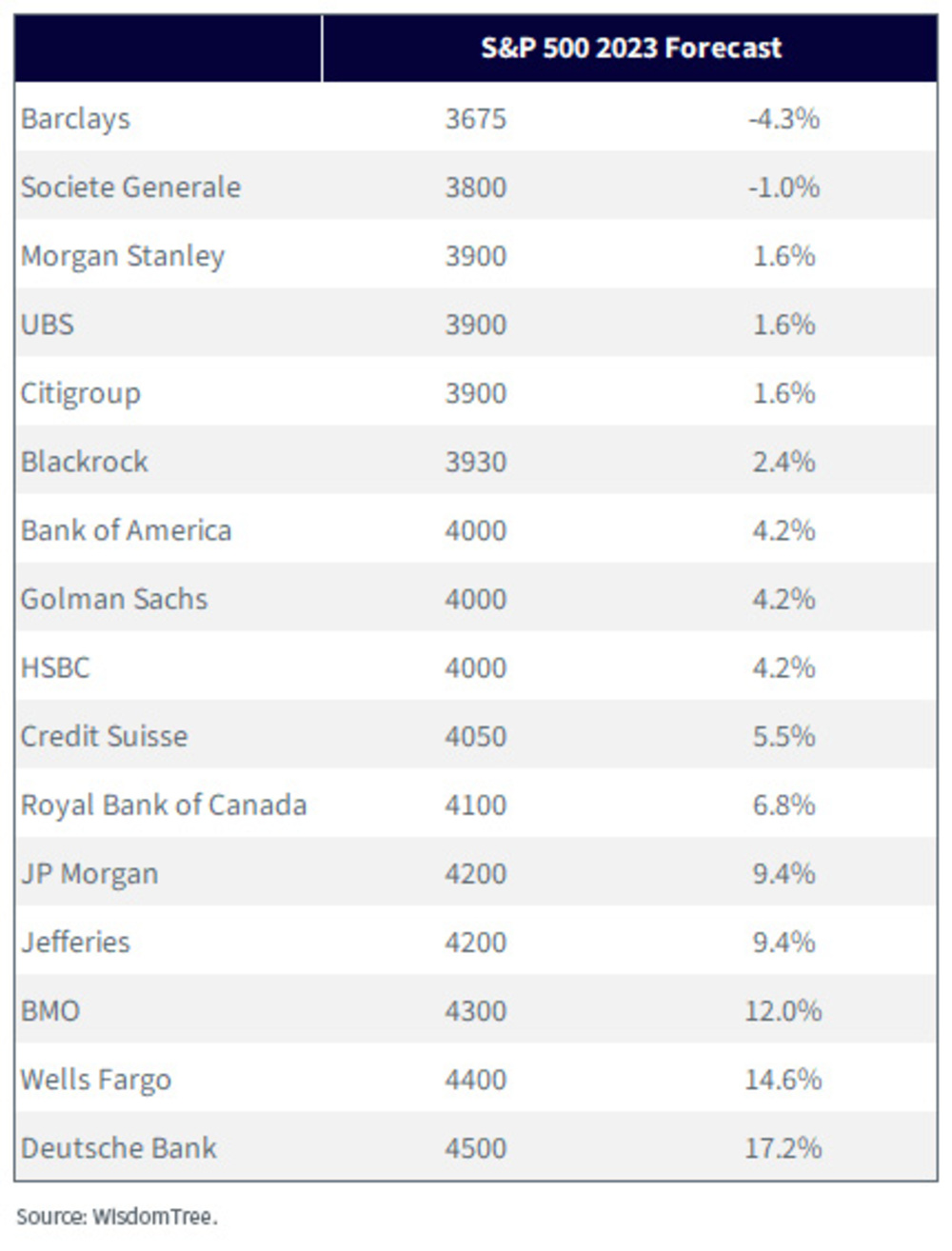

Not only is it difficult to time unknown market events, even predicting the next calendar year’s stock market performance is challenging. For instance, the S&P 500 delivered a stellar 24.2% return in 2023—a fantastic year for U.S. stocks. Yet, even the sharpest forecasters missed the mark, with none coming close to predicting such a strong year. When reviewing forecasts from some of the world’s largest banks, two things become clear:

- There was a massive gap—21%—between the most optimistic and pessimistic forecasts.

- None accurately predicted the outcome, with only three forecasters projecting double-digit returns.

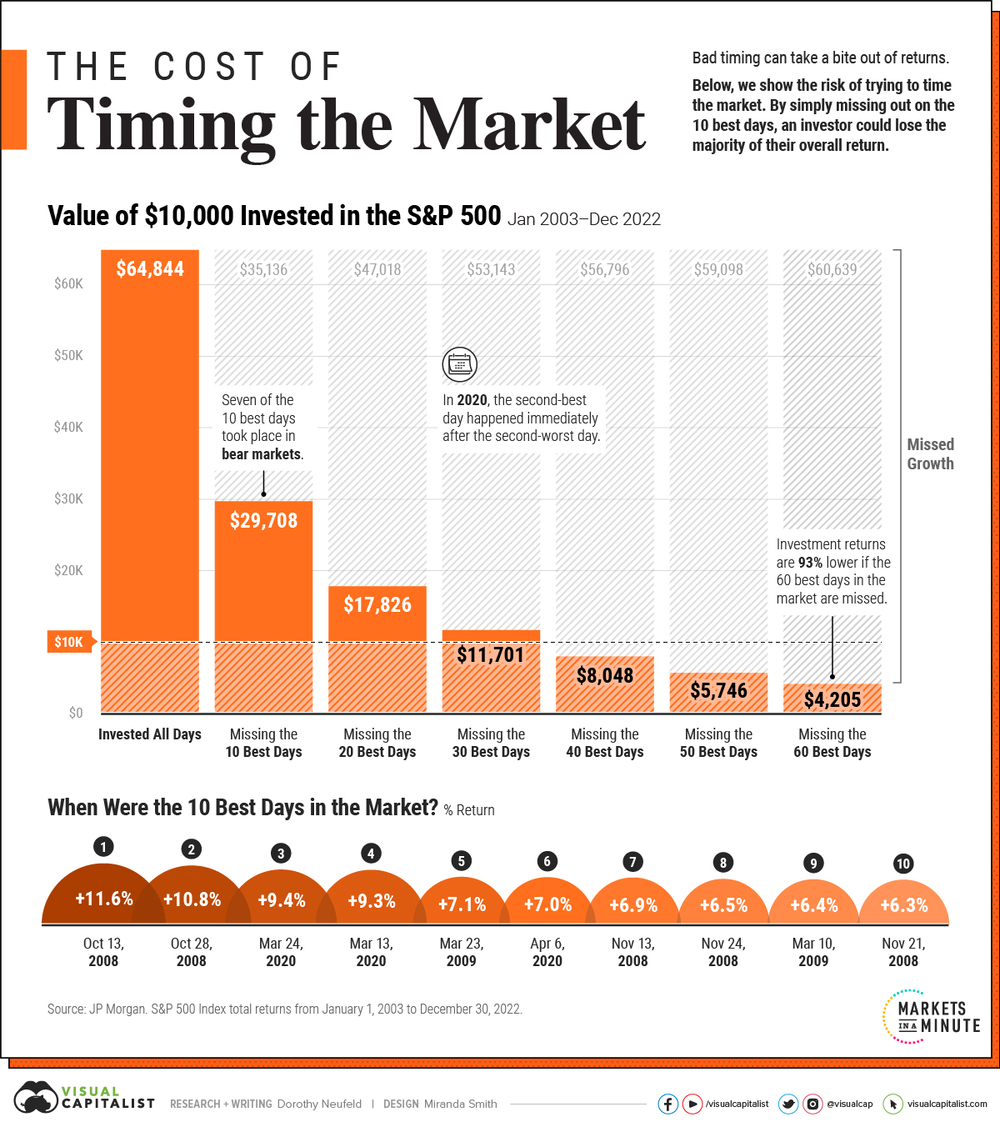

So, what should investors take away from this information? Ultimately, it reinforces our investment philosophy that short-term market movements are unpredictable, and that investors who focus on the long term and remain invested are ultimately rewarded. In fact, some of the best days in the stock market occur during downturns. To further solidify this conviction, consider the following graphic, which illustrates the power of staying invested:

Here are three lessons we can learn from this week’s market volatility:

1. Diversification matters. Despite equities selling off in the first week of August, other assets such as bonds yielded positive returns. The importance of diversification is paramount in times of market corrections, and having a well-diversified portfolio will protect you from short-term volatility in stocks.

2. Think long-term. It is important to try not to “beat” the market by jumping in and out, and by trying to follow the latest fad. Over a 10-year period, only 12.58% of fund managers have managed to outperform the US stock market. Therefore, our philosophy remains that a buy-and-hold strategy remains superior especially during periods of uncertainty.

3. Work with a financial planner. One of the most valuable things a financial advisor can provide clients is by helping them navigate down markets and help them make informed decisions with a long-term outlook. One of the most powerful tools to achieve this is a well-documented financial plan that both the advisor and client can hold themselves accountable to.

Conclusion

In conclusion, market corrections and volatility are inevitable, but they don’t have to be feared. By understanding that these fluctuations are a normal part of the investment journey, you can approach them with a long-term perspective. The wisdom of staying invested, rather than trying to time the market, has been proven time and again. History shows that those who remain patient and disciplined are ultimately rewarded, even in the face of short-term setbacks. As we navigate the ups and downs of the market, remember that consistency and a focus on long-term goals are your best allies in building lasting wealth.

We Can Help

We’re here to help you stay on track and thrive in market uncertainty. Connect with us today to secure your financial future.