Canada’s financial landscape is undergoing a significant shift with the unveiling of the 2024 proposed Federal Budget. Among the proposed changes lies a pivotal adjustment to the capital gains inclusion rate that has taken headlines by storm as of late. While still subject to passing, the proposed changes are set to increase the capital gains inclusion rate from 66.67% from its current 50%. For investors and entrepreneurs alike, this alteration prompts a crucial examination of wealth-building strategies and tax efficiency.

Understanding the Impact

At the heart of this change is the recognition that tax efficiency plays a pivotal role in wealth accumulation. With the proposed alteration in capital gains inclusion rates, individuals and corporations are left pondering the implications for their financial portfolios.

Individual Implications

For individuals, capital gains realized before June 25, 2024 maintain the current 50% inclusion rate. However, transactions occurring after this date will see a nuanced adjustment: the first $250,000 of gains will retain the 50% inclusion rate, with any surplus subjected to the increased 66.67% rate.

This alteration translates into a tangible impact on taxation. Individuals facing capital gains above the $250,000 threshold will witness their average tax rate rise to 33.8%, up from the previous 25.3% (assuming you are taxed at the highest bracket).

Optimize Your Investment Strategy

Join our community of high net-worth investors by subscribing to our monthly newsletter. You’ll receive tips on tax planning, investment trends and more.

Corporate Considerations

Corporations, regardless of their nature (operating, holding, or professional), face a uniform adjustment. Following June 25, 2024, all capital gains realized within a corporate entity will be taxed at the higher inclusion rate of 66.67%. Unlike the previous system, there will be no 50% inclusion rate applicable to the first $250,000 of gains.

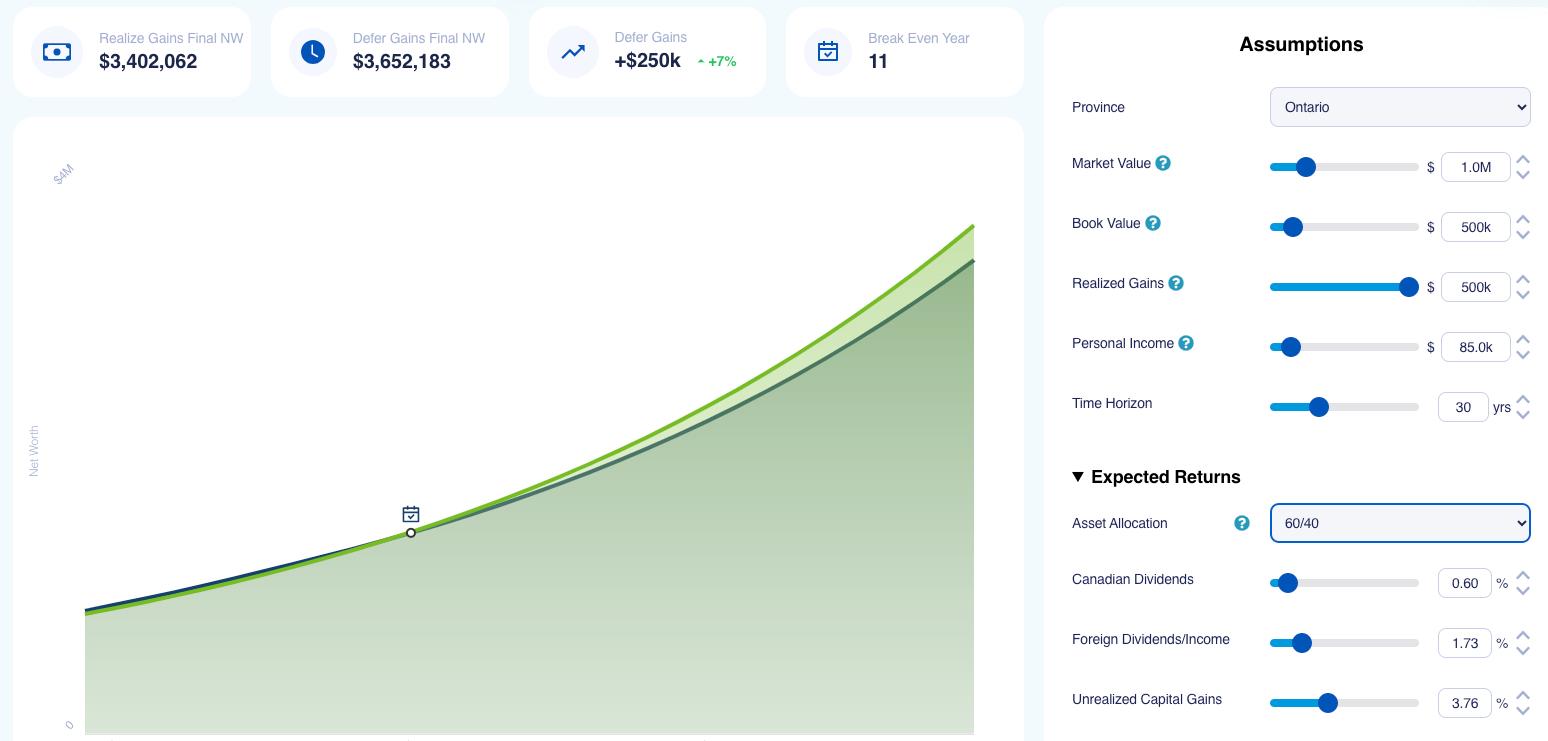

Strategic Planning: Pre-June 25th 2024 Transactions

In light of these changes, strategic planning becomes imperative. Investors and business owners must carefully evaluate their positions and adopt proactive measures to mitigate potential tax burdens. For those contemplating transactions involving securities, the debate between triggering taxable gains now at lower inclusion rates or leveraging the power of tax deferral can prove complex. The decision to sell before June 25th 2024 hinges on various factors, including the individual’s tax bracket and expected future gains. By conducting a “break-even analysis”, we can offer our clients invaluable insights to help make informed decisions aligned with their financial objectives. We analyze all the variables of a client situation using comprehensive financial planning software, however for illustrative purposes this simple calculator can highlight the value of such analysis.

For example, assume a client has:

-$1,000,000 Non-Registered Portfolio, with a Cost Base of $500,000.

-30-year investment time horizon

-Invested in a balanced portfolio of 60% equities, 40% fixed income.

-Earning an annual income of $85,000

The question being posed from this hypothetical client with the proposed capital gains inclusion rate deadline looming is – does it make sense to trigger my capital gains now at a lower inclusion rate?

According to the assumptions taken, there would be a net tax savings if the client did so up until year 11. Afterwards, the client is actually better off remaining invested, as the compounded interest generated from remaining invested would begin to exponentially outweigh the initial tax savings from triggering gains now. In fact, this client would have a portfolio after 30 years that is $250,000 higher if they just remained invested!

Looking Ahead

The proposed Federal Budget to increase capital gains inclusion rates has prompted questions for many of our clients wondering how this applies to them. We are here to help with these discussions and facilitate the progress of your financial planning goals. As always, we look forward to supporting you by empowering you to make an informed decision and navigate change with confidence.

We Can Help

We’re here to simplify the complexity and help you navigate confidently. Let’s discuss personalized strategies to secure your financial goals. Reach out today to get started.