Investors have long explored ways to optimize their returns while managing their risk. For decades, mutual funds have been the primary investment vehicle for investors to achieve their investment goals. In fact, mutual funds are still the most popular investments by market share.

However, recent statistics highlight how rapidly things are changing with the emergence and growth of Exchange-Traded Funds (ETFs).

Globally, ETFs have increased from $204 billion USD in 2003 to over $9.6 trillion USD as of 2022, representing a compounded annual growth rate of over 15% since 2010 and growing 3x faster than mutual funds over the same period. In this blog post, we’ll explain how an Exchange-Traded Fund differs from a mutual fund and outline the key reasons why investors have been adopting this investment vehicle at such a rapid pace.

Understanding ETFs

An Exchange-Traded Fund (ETF) is an investment fund that trades on stock exchanges, holding assets such as stocks, bonds, and other investments. ETFs are Like mutual funds except they trade throughout the day and are more tax-efficient, transparent, and accessible. Due to the efficiency of their structure, they are also often cheaper than their mutual fund counterparts.

Need help navigating investing strategies?

Lower Fees and Their Impact

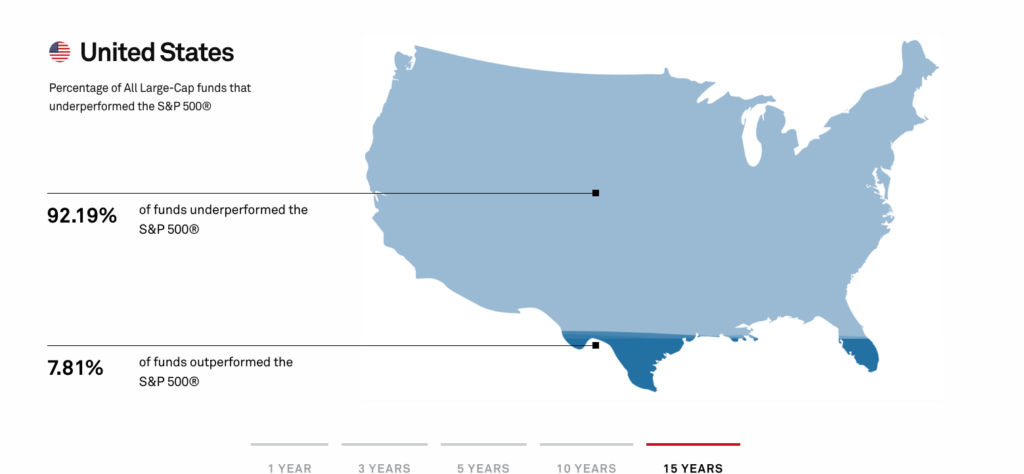

If you’ve heard of ETFs, you’ve probably heard it immediately associated with lower fees. This is because ETFs are typically passive investments, meaning they are designed to replicate an index. Conversely, mutual funds often employ “active managers” with the goal of beating their benchmark. An example of this would be a US Growth Equity Fund, whose benchmark is the S&P500. In this example, the fund charges a 1% fee to manage the mutual fund. The investor can compare the returns of the mutual fund with the benchmark to see how the fund is doing. If they outperform their S&P500 benchmark, the investor would be happy to pay the 1% fee, right? The reality is that mutual fund managers have long been unable to replicate or outperform their benchmark consistently. As seen below, the S&P Indices Versus Active (SPIVA) Scoreboard shows how U.S. Active Mutual Funds have performed versus the S&P500 over the past 15 years.

As seen above, only 7.81% of US-Listed Actively Managed Mutual Funds have outperformed. This can be attributed in part to higher fees and the efficiencies of markets over long-time periods, amongst other factors. However, what is clear is the benchmark is tough to beat over the long-term. These trends have shifted the conversation toward utilizing passive Index-replicating ETFs, as the fee savings and overall performance benefits have been tough to compete with.

Illustrating Tax Efficiency

The lower fees that are attributed to ETFs are widely talked about, and for good reason. However, perhaps more attractive are the tax efficiencies when compared to mutual funds.

A study by Morningstar unveiled that the average equity mutual fund lost 1.48% of their returns to taxes from 2010-2020. This concept is known as “tax drag”, which can be defined as the loss of investment returns because of taxation. The primary reason for this is due to how a mutual fund operates. Mutual funds incur taxable capital gains when managers sell securities to meet redemptions, passing the tax burden to investors annually.

In contrast, ETFs are built to avoid capital gains that result from turnover and redemptions. ETFs use an in-kind creation/redemption process, avoiding taxable events and minimizing capital gains for investors by creating or destroying shares of an ETF without buying or selling holdings to meet investor demands. This process offers investor liquidity without triggering capital gains to do so.

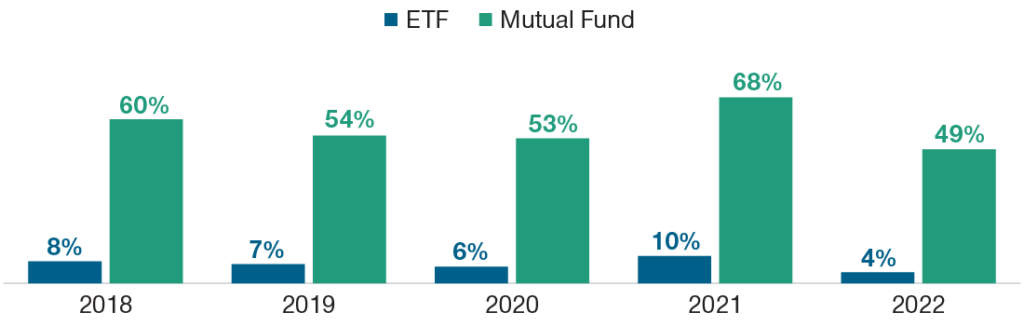

The figure below illustrates this concept by showing the percentage of US-Listed mutual funds that made capital gains distributions over the past 5 calendar years. It is clear to see that ETFs have distributed far less due to their structural efficiencies.

Take for example the year 2022, where major US Equity indices were down 17-18%. In the Figure above, 49% of mutual funds still distributed capital gains to their investors. Therefore in 2022, it is likely that mutual fund investors saw their portfolios shrink, and yet still owed taxes.

In conclusion, ETFs can carry big advantages over Mutual Funds that result in net fee and tax savings to the investor. However, it’s important to consider your individual situation and what makes sense for your investment accounts. With the momentum we’re seeing in ETFs and the benefits listed above, it is evident that they will continue to play a significant role in investor portfolios for years to come.