Summertime is finally upon us, and with it many Canadians have exciting plans to get outside and enjoy this beautiful weather while it’s here to enjoy. Summer is the most enjoyable time of year for many, with countless ways to spend it in this gorgeous country of ours, however it does tempt the little spender hiding in us all.

In fact, according to Statistics Canada, households spent $12.5 Billion last summer on recreational activities & sporting events alone! Summer is my favourite time of year, but between the baseball games, restaurants with gorgeous patio views, and road trips to the beach or a cottage, it is a time of inevitably higher expenses. The topic of today’s post is to help our clients make the most of their summer while being conscious of their finances, and what better way to do it than a good old-fashioned budget this summer season!

To some when they hear the word “budget”, a negative connotation might immediately pop into mind such as the following: restricting, confusing, hard work, time-consuming. It can certainly feel this way, and I can also attest to the ordeal being rather overcomplicated if poorly executed, but it does not need to be any of these. In fact, a well-thought-out budget often has the opposite effect: liberating, educational and minimal effort. Below, we will detail how we look at and categorize expenses, as well as share our simple way of budgeting our own personal finances.

“A budget is telling your money where to go instead of wondering where it went.”

– Dave Ramsay

Fixed Expenses vs Flex Expenses

During our introductory financial planning sessions with a client, at some point we will tend to ask, “what are your monthly expenses?”. The question is left intentionally broad so the client can consciously think about what their household spends on. As they mentally add up their expenditures, they tend to articulate them back to us in two phases: the first being their Fixed Expenses (i.e. utility & phone bills, insurance, groceries, gas, mortgage/rent payments) and the second being their Flex Expenses (i.e. vacations, dining out/takeout, sports & leisure, shopping). This is an important distinction in any budget, and it is the easiest way to begin dissecting spending habits.

For clients who ask for help increasing their net cash flow, we start by asking them about their Flex Expenses as they are the easiest to influence. Throughout the financial planning delivery process, we will show them how their current expense levels compound over the years with respect to savings, debt repayments and investing. Then we will show a second scenario with minor tweaks to lower Flex Expenses in agreed- upon areas and highlight how this difference compounds their savings rates and frees up their cash flow. Clients are often surprised at how a small change can make a big difference over time, and this leaves them with excitement and motivation to begin effectively budgeting and saving. One question remains for clients, and that is how do we do it?

Maximize Your Budgeting Strategy

Join our community of high net-worth investors by subscribing to our monthly newsletter. You’ll receive tips on tax planning, investment trends and more.

Ways to Budget

The traditional way to budget is by creating one yourself, whether by pen and paper or excel spreadsheet. There are benefits to this method because the art of writing down your expenses line by line ensures you are practicing the art of consciously observing your spending habits. By reviewing and categorizing your Credit Card statements and bills by hand, you will have a sure-fire way to effectively understand your monthly cash flow. For many of our clients, this works fantastically. And to them, we say more power to you! The best budget is the one you follow. It’s no different from a diet plan, and it’s equally effective.

However, for clients that began to think those negative connotations as I described the above method, there is an alternative. Over the years, there have been many Budgeting Apps that have gained popularity, such as You Need A Budget and EveryDollar. The problem with these is that they are all US-based and none are compatible with Canadian Institutions! The budgeting app used by many Canadians (including ourselves) formerly was Mint, however as of this year they are no longer in operation.

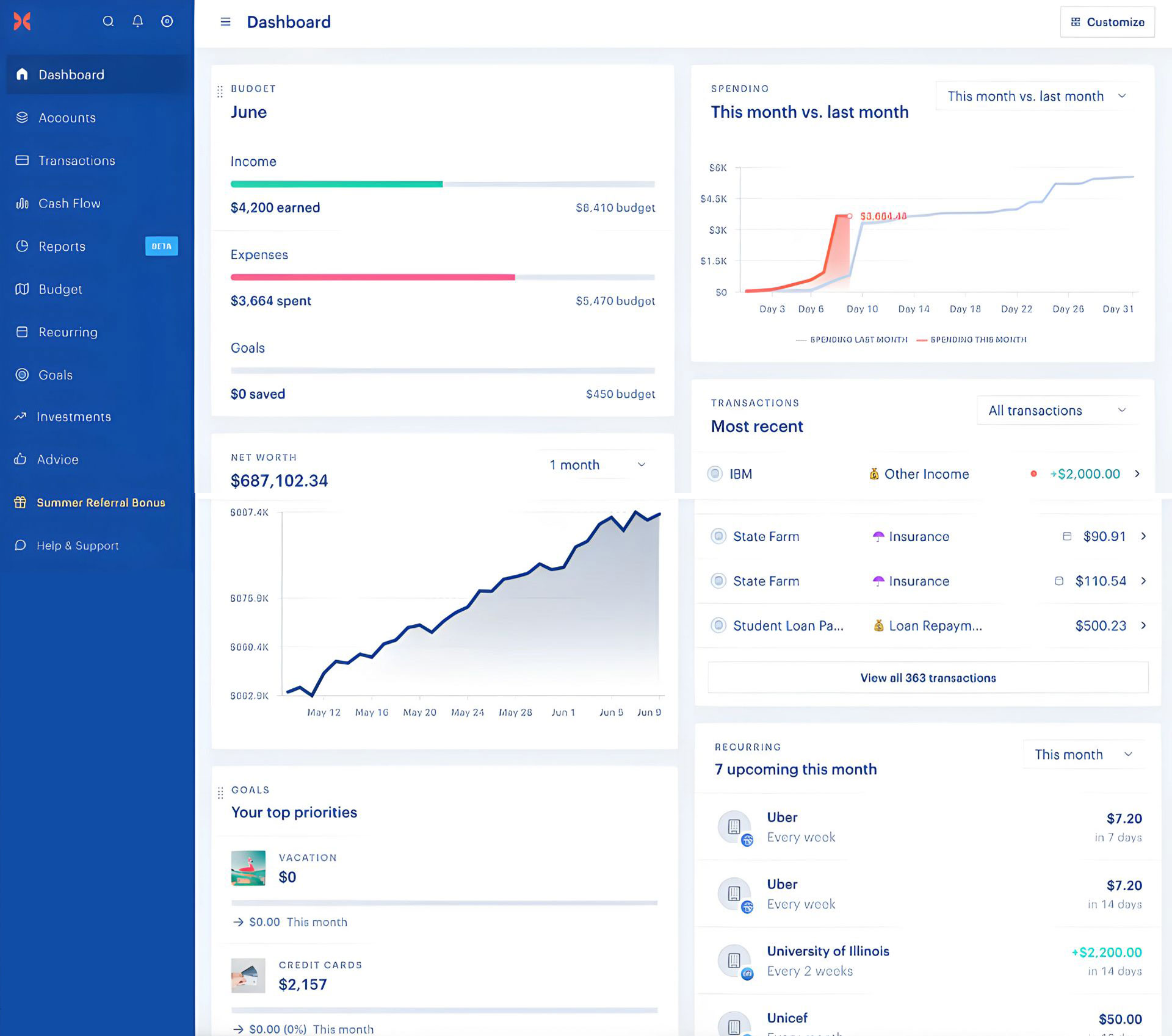

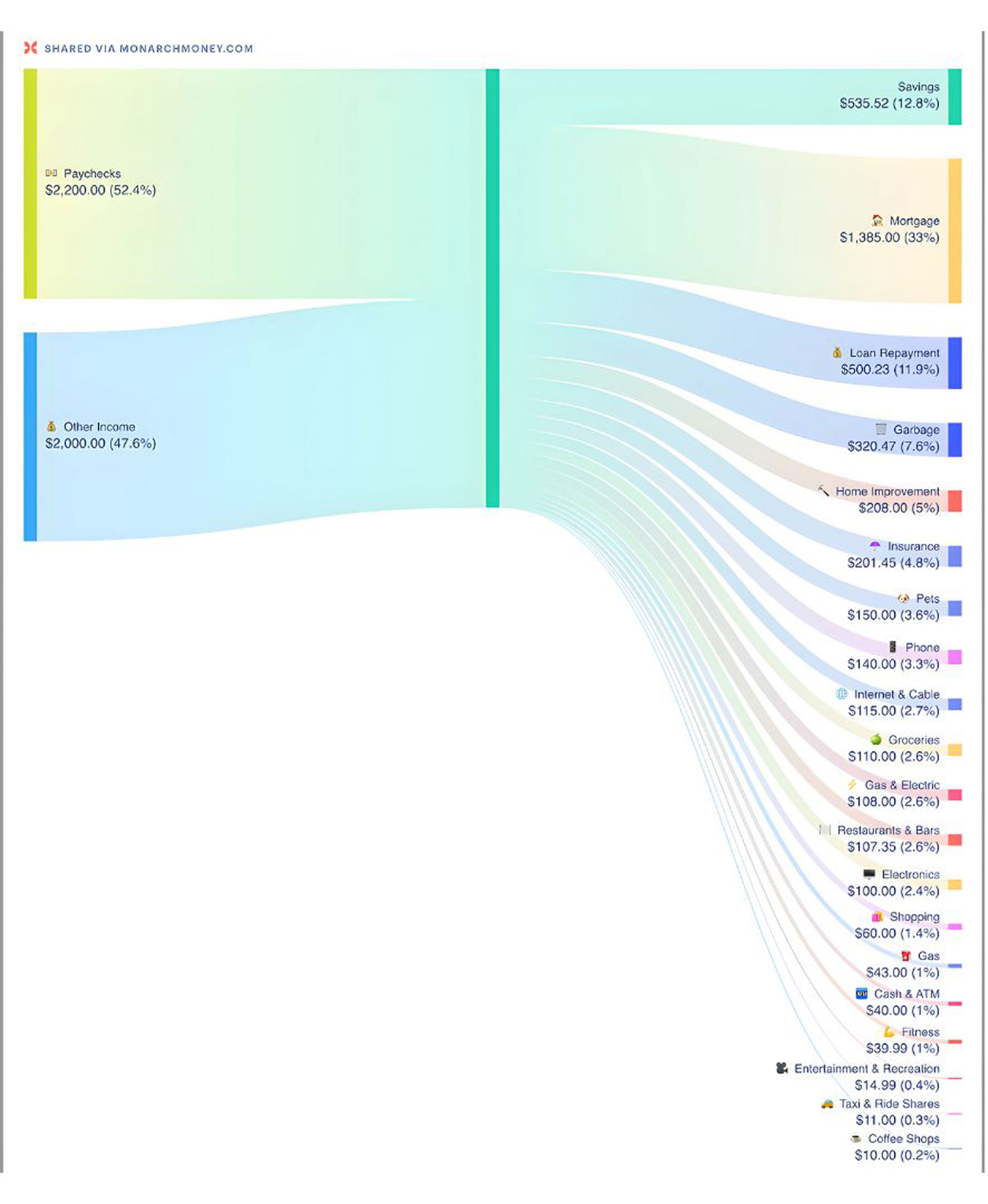

Thankfully another App came into the Canadian Retail Market recently called Monarch Money. For a subscription fee of $9/month, this application allows you to connect your banking institution to track and categorizes your monthly expenditures. Monarch helps you budget by setting up a goal monthly budget target for every fixed and flex category (such as rent, groceries, dinners out, etc). From there, the App tracks and categorizes all your monthly purchases and compares it to your previously set monthly target, allowing you to compare your spending to your targets throughout the month. This is an application we’ve been using personally for its budgeting accountability benefits. However, we must stress this is not a paid advertisement and we do not have any referral agreements with Monarch. This is simply a recommendation for an App we enjoy.

For your interest, we’ve included screenshots below to highlight what the end user experience looks like.

As mentioned, the best way to budget is to use the method you are most comfortable with and are likely to repeat.

As we continue to enjoy this beautiful weather we are having, a conscious re-think about our Fixed and Flex expenses can be more liberating than we think, and may just provide the financial peace of mind that allows us to stay mentally present while we enjoy our plans with beloved friends and family.

As always, we’re here for you to help with Cash Flow planning and discuss how to maximize your savings habits.

We Can Help

We’re here to help you maximize your savings habits and improve your cash flow. Connect with us today to start planning a more secure financial future.