As the Canadian Baby Boomers mature, it is estimated that the next generation will stand to inherit approximately $1 Trillion, with roughly 70% of that in the form of financial assets.

As this dynamic unfolds over the decades to come, it will be the largest recorded inter-generational wealth transfer in Canadian History. In response to the staggering statistics, IPC Private Wealth has conducted a study which yielded interesting results:

- 58% of Canadians haven’t discussed instructions for their estate with their heirs.

- 32% of affluent Canadians worry about how their heirs will handle their inheritance.

- One in five (20%) fear that their children will not have anything to pass down to their own children.

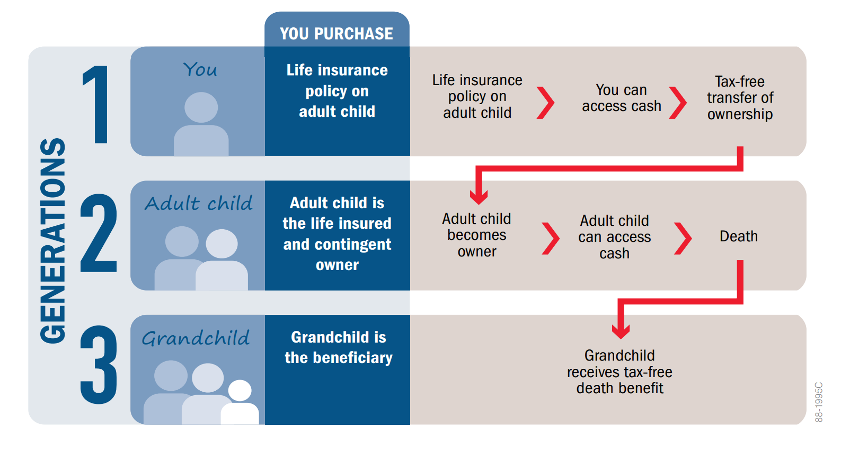

As we see these trends continue to unfold, it is important to prepare accordingly with unified family planning. Although every family’s needs are different, one strategy we’ve implemented where it fits results in tax-sheltered accumulation and an efficient transfer to children and/or grandchildren free of income tax and probate fees. This concept is known as a Cascading Insurance Strategy.

Cascading Insurance Strategy

A Cascading Strategy is the concept of using permanent life insurance to cascade wealth beyond one generation. Typically, we use this strategy during times that our clients have sufficient wealth to fund their own lifestyle and want to gift assets to their kids while they’re still alive.

How it works:

- A grandparent (first generation) purchases a whole life insurance policy and makes a pays into it over 5-10 years. The grandparent is named the policy owner.

- The adult children (second generation) are named as the contingent owner(s) and their lives are also the ones insured in the policy.

- The grandchildren (third generation) are named as beneficiaries.

Benefits to Each Generation

Grandparents (First Generation)

- Allows for grandparent to maintain control of his or her cash value in the policy, even if someone else is the life insured.

- Unlike some investments that can lose significant growth in annual taxes, the accumulated growth is tax-sheltered within the policy.

- Although the policy owner is unlikely to need to use the value built up in the policy, they can maintain control and access it whenever they like.

Adult Children (Second Generation)

- Policy ownership will be transferred to the insured (adult children) upon the grandparents passing. They will remain the insured, with the grandkids still named as beneficiaries.

- The adult children will then have access to the cash value in the policy.

- The adult children can access the cash value in three different ways:

- Partial Surrender – Withdraw from cash value, resulting in potential taxable event or a reduction in death benefit.

- Policy Loans – The insurance company advances a loan to the policy owner, secured against the policy’s cash value. Any unpaid loan and interest accrued will then be deducted from the policy death benefit upon the adult children’s passing.

- Collateral Loan – A third-party lender offers a loan or line of credit, secured by the policy. Interest must be paid back on the loan.

Grandkids (Third Generation)

- Once the adult children pass away, the grandkids will receive the tax-free death benefit as they are named as beneficiaries.

- Since they are named as beneficiaries of the death benefit, the entire death benefit will bypass the parent’s estate and payout to the grandchildren tax-free and exempt from probate fees.

Who is The Cascading Strategy For?

- Clients who have accumulated more wealth than they will use in their lifetime.

- Clients who have received significant inheritance and do not need all of it.

- Clients who intend to help their families financially support life events.

- Clients who want to protect the money they leave behind for future generations.

In conclusion…

Inter-generational wealth transfer is a subject of increasing importance for the affluent and aging Canadian. While there are many ways to approach your legacy goals, the Cascading Life Insurance Strategy could be a viable option for you to consider. Depending on your situation, it be the peace of mind your family is looking for knowing they have their generational wealth transfer plan in place.